November is Diabetes month.

A shocking 9 million Canadians live with diabetes or prediabetes and 371

million people globally are living with the disease (although it is estimated

that an additional 187 million people have no idea that they are suffering from

the condition). Estimates predict that

one-third of Canadians and 552 million people globally will have diabetes by

2030. This number is shocking

considering that diabetes was largely non-existent only decades ago.

Diabetes describes a medical condition where a person has

high blood glucose (blood sugar). 90% of all cases worldwide are Type 2

diabetes where the body does not produce enough insulin or the body does not

properly use the insulin it makes.

Insulin is important to help your body control the level of glucose in

the blood and obesity promotes insulin resistance.

The Globe and Mail had an entire section on diabetes in

yesterday’s edition of the paper. I

found two things particularly striking.

The first was the content of the stories in the newspaper. Some chronicled the lives of people with

diabetes, others talked about the importance of medical treatment of diabetes –

particularly the need to shift from acute to chronic care – while others

promoted the importance of exercise and an active lifestyle. Although there was mention here and there

about eating habits, the only dedicated story I could find about the role of

food and beverage companies in the diabetes epidemic was on the back page on

the bottom right hand corner where there was a brief article warning consumers

about the breakfast cereal they choose to purchase and consume. I found this striking, largely because the

primary cause of diabetes and obesity is not exercise or poor treatment but

eating habits and the proliferation of processed foods that dominates the

supermarket. The food and beverage industry

produces enough food for each person on the planet to consume 3900

calories. The average consumption rate

is 2800-3200 calories and the recommended calorie intake is 1800-2000 for

females and 2200-2400 for males. A brisk

60 minute walk would expend 280 calories, not nearly enough to offset the

increased calorie intake that we’re seeing today. So then why don’t we see a dramatic

educational platform that educates consumers to move away from processed and

highly fortified foods?

The second surprising thing I noticed was a large one-page

advertisement for a diabetes awareness event with a listing of the sponsors for

the event. Almost all of them were

grocery store chains – Loblaw, Safeway, Metro, Zehrs, Your Independent Grocer,

among others. I was aghast from the

irony to the point where the secretary at the dentist office I was waiting in

thought I read a funny joke.

Perhaps I had.

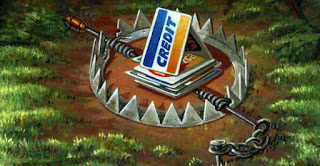

Here we have the proliferation of one of the most widespread

diseases in our society linked closely to one of the most alarming trends in

our society (obesity), and the main sponsors of creating awareness are the same

companies that litter 90% of their stores with the very crap that is causing

the disease. Walk into any one of these

grocery stores and you’re bombarded by messages to purchase and consume

unhealthy products.

But then is it really their fault? Isn’t the food in these grocery stores merely

reflecting consumer demand? I’m sorry to

say that anyone who thinks that these grocery store chains are not complicit in

the proliferation of diabetes does not understand the fundamentals of

business. The food that would sharply

curb the incidences of diabetes (e.g. fruits and vegetables, cheese, and nuts)

have virtually zero profit potential for business, which is why these sorts of

products are relegated to the outside aisles of the grocery store, perceived as

poor cousins to the very sexy and highly marketed value-add processed goods

that have some tiny yet manipulated remnant of one of these raw foods. The money lies in processed food where food companies

can add value to products and grocery store chains can capture a larger

percentage of the price for their own margin.

On top of this, as a grocery store you’d be more interested in selling

products that have properties that would encourage consumers to buy more. Sugar, salt and fat are addictive, so if I’m

a smart business person, I know that it would be more worthwhile for me to

stock my shelves with foods containing these ingredients than with foods that

don’t. As a consequence, because consumer

responsibility implies choice, grocery stores play a very active role

(intentionally or not) in limiting the choice available to consumers so that

they purchase higher margin, addictive products.

The irony behind grocery store sponsorship of diabetes

awareness reminds me of Corporate Knight’s recent endorsement of Loblaw as the

most responsible company in Canada. In

another blog posting, I put forward a rather harsh criticism of this

endorsement largely because Corporate Knights completely overlooked the

products in the store aisles and the impact these products have on society and

the environment.

These sorts of “slap in the face” initiatives by companies

drive me absolutely nuts! Any company

representative reading this will remark on how much they’ve improved their

healthy product offerings through an organic section or through more general

healthier alternatives. But what they

can’t come to grips with is that their business model is fundamentally at odds

with societal interests to reduce obesity and diabetes. I sympathize with these companies. How would you feel if a majority of your products that you sell to consumers is closely linked to a disease that is killing them? On the other hand, it's important to consider purchasing power these grocery chains have to elicit change in the food and beverage supply chain. Are they using it to the best of their ability? Shouldn't they be spending their resources on making these more fundamental changes to the food and beverage value chain rather than spending it on these sorts of sponsorship activities that represent band aid solutions to a more complex problem?